A bipartisan agreement to suspend the government’s $31.4 trillion (€29.4 trillion) debt cap on 1st June 2023, was approved by the US Senate. After months of partisan debates between Democrats and Republicans, the Senate finally passed the bill with a vote of 63-36 in a race against time. A statutory cap on the total amount of debt that the US government can issue to fund its operations is referred to as the “debt ceiling.” It essentially sets a limit on how much overall debt the US government may have outstanding at any given moment. The debt ceiling, on the other hand, is determined by Congress and acts as a measure to restrain governmental borrowing. It is meant to prevent excessive government debt accumulation without sufficient inspection and approval. If the debt ceiling is reached, unless Congress decides to increase or suspend it, the Treasury Department is not permitted to issue further debt to pay its financial obligations. This article gives a quick outline of the US economy’s increase of the debt ceiling and possible effects on developing countries.

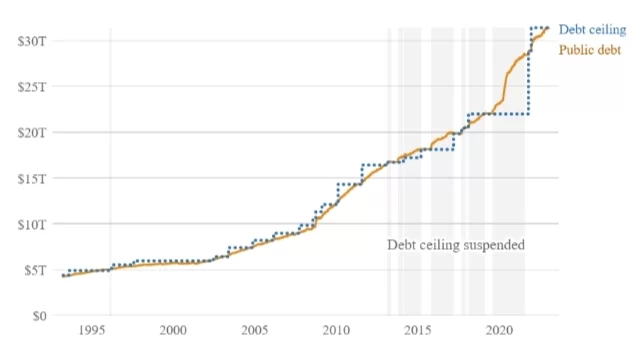

Figure 1: Debt Ceiling and Total Public Debt of the US

According to the Department of Treasury, Congress has increased, extended, or altered the debt ceiling 78 times since 1960, including 29 times under Democratic administrations and 49 times under Republican administrations. Each time, Congress raised the debt ceiling before the country went into default. However, the Treasury Department reports that January 1835 was the first and only time the whole amount of interest-bearing government debt was paid off. President Andrew Jackson liquidated the Second Bank of the United States, restoring the government’s initial investment with a profit. Jackson was wary of banks and did not trust the paper money they issued. As a result, the government ended the year with a massive $17.9 million cash surplus, considerably in excess of what it actually spent. Moreover, only the US and Denmark continue to have a debt ceiling. Denmark’s debt cap, however, is significantly higher than the country’s spending, therefore there are rarely any threats to the stability of the economy. Denmark’s debt in 2021 was almost 14% of its debt maximum.

Understanding the effects of lifting the debt ceiling is essential since they could have a big impact on developing economies. A “debt ceiling breach” or “debt ceiling crisis” could occur if the debt ceiling is not lifted and the government uses up all of its cash reserves and exceptional measures to pay its debts. The government might not be able to pay its debts in this case, including interest on current debt, social security benefits, employee salaries, and other obligations. The economy, financial markets, and the creditworthiness of the government may all suffer significantly as a result of this. In the past, to prevent a default on US government debt, Congress has frequently increased or temporarily suspended the debt ceiling. However, lifting the debt ceiling has frequently been the focus of political discussion and negotiations, with various parties and groups using it as a tool to further their political objectives or press for concessions on other matters.

It’s crucial to remember that the debt ceiling has no direct influence over or restriction on government spending. It operates independently of the budgeting process, which establishes how much and on what the government can spend money. After such choices have been made, the financing of those expenditures is governed by the debt cap.

The Debt Ceiling is Needed for Several Reasons

By establishing a cap on how much debt the government can issue, the debt ceiling acts as a measure to encourage fiscal restraint. It encourages policymakers to make wise choices on spending and income by requiring them to think about the long-term effects of raising the national debt. Besides, the debt ceiling gives Congress the power to monitor and regulate the government’s borrowing. It makes ensuring that decisions about the issuing of debt are reviewed and approved by the legislature. However, it makes the government’s borrowing more transparent and makes it answerable for its actions. It forces decision-makers to defend the necessity for more debt and to hold a public discussion on the possible repercussions of doing so. It also affects how much debt the country has or can have. The Treasury Department can plan and carry out its borrowing activities within the permitted limit using the framework it offers. It contributes to the stability and integrity of the government bond market by putting a cap on debt issuance.

In political and budgetary discussions, the debt ceiling has frequently been utilized as a negotiating tactic. Legislators may use it as leverage to demand policy modifications, financial adjustments, or concessions on other matters. However, using the debt ceiling as a negotiating chip can also make the economy unclear and potentially risky. It’s important to remember that there has been discussion over the usefulness and necessity of the debt ceiling. The debt ceiling, according to its detractors, is an arbitrary cap that can impair the government’s ability to function and the financial markets. They recommend several methods of fiscal management and oversight, like thorough budget changes or automatic spending controls. However, for the time being, the debt ceiling is still a feature of the American budgetary system.

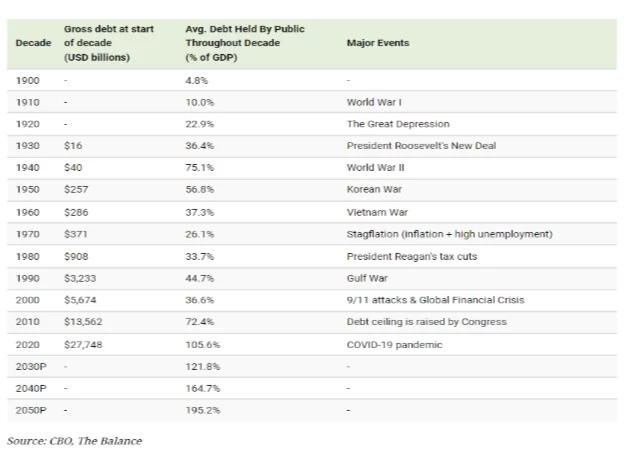

Figure 2: The US’s Debt and Percentage to its GDP

Consequences on Developing Economies

Raising the United States’ debt ceiling may have indirect effects for developing nations, depending on a number of variables. A few possible consequences are as follows:

Change in Global Financial Stability

Because of the significant role the US plays in the global economy, any interruptions or ambiguities relating to its debt ceiling may have an impact on financial markets all over the world. A global economic downturn might be brought on if the US went into default on its debt or experienced extreme financial instability as a result of a debt ceiling issue. Reduced trade, investment, and financial flows would probably have an impact on third-world countries.

A Surge in Interest Rates and Capital Flows

A US debt ceiling crisis could result in higher interest rates and higher borrowing costs. Due to the fact that international interest rates frequently increase in response to a country’s financial instability, this may make it more expensive for developing nations to borrow money abroad. Higher borrowing costs can impede economic growth and make it more difficult for these nations to engage in social programs, infrastructure, and poverty alleviation efforts.

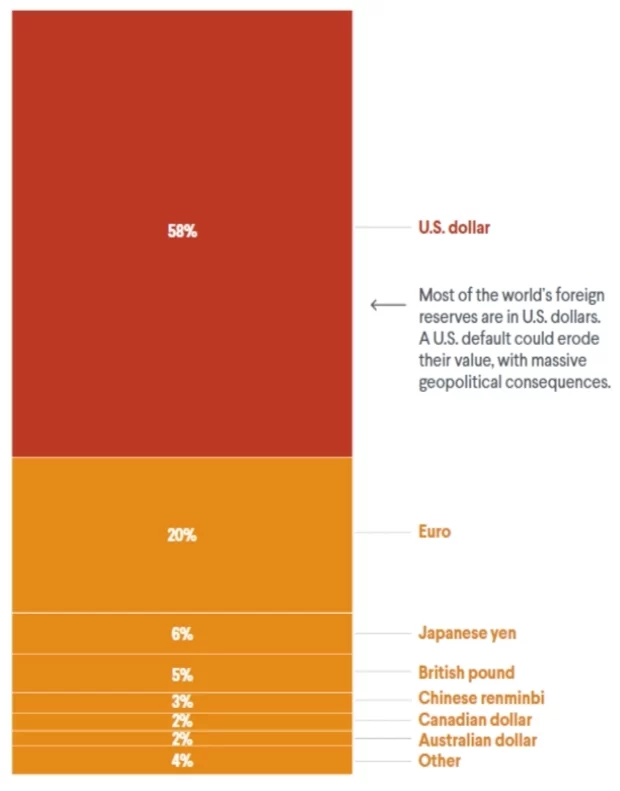

Impacts on Foreign Reserves

More than 50% of global foreign currency reserves are currently invested in U.S. dollars, making it the dominant reserve currency worldwide. Consequently, any abrupt devaluation of the US dollar could have profound implications for the treasury market as the declining value of these reserves reverberates across financial systems. This situation is particularly concerning for economically disadvantaged nations burdened with significant levels of debt. These low-income countries are already grappling with the challenge of meeting interest payments on their sovereign debts. As a consequence, the relative affordability of servicing their debts could deteriorate, potentially pushing several emerging economies towards the brink of debt crises or even political instability.

Figure 3: A US Default Would Cause Global Economic Chaos

Decline in Development Assistance

The US plays a significant role in providing third-world nations with development assistance. Last year, the US provided $55.3 billion in development assistance worldwide. However, recent debt ceiling issue may hamper the US’s ability to provide funding for initiatives aimed at eradicating poverty, providing healthcare and education, and providing humanitarian aid abroad if there is a debt limit issue. This might result in a decrease in aid to these nations, which would have an effect on their development efforts.

Disruption in Trade and Economic Relations

If the US debt limit issue results in a downturn or recession, this might stifle demand for products and services globally, which would have an impact on the export-driven economies of third world nations. The export earnings and chances for these countries’ economies to flourish might be harmed by decreases in trade volume and reduced commodity prices.

In a nutshell, the particular effects for developing nations will vary depending on their unique situations, economic setups, and reliance on the US as a trading partner, investor, or assistance provider. This is vital to keep in mind that the impacts may be visible in shorter or longer period of time. Additionally, international financial institutions like the World Bank and the International Monetary Fund (IMF) may be able to mitigate some of the possible drawbacks by how they respond to the situation and take appropriate action. But the change in the economic status will be experienced by the third world countries which can trigger more instabilities.

*Muhammad Estiak Hussain is a Research Assistant of The KRF Center for Bangladesh and Global Affairs (CBGA).

*Syed Raiyan Amir is a Research Associate at the KRF Center for Bangladesh and Global Affairs. The views and opinions expressed in this article are those of the authors.